A Modular, AI-Driven Platform for Auto, Equipment, and Asset Finance

Accelerate credit decisions, streamline servicing, and ensure compliance—on a platform that integrates easily and scales to meet the needs of your organization.

Why Transcend Finance?

Advanced security frameworks and proactive monitoring protect sensitive data and reduce exposure to modern cyber threats across your operations.

Pre-configured compliance workflows simplify regulatory reporting, reduce human error, and help you stay aligned with evolving financial standards.

Transcend eliminates manual inefficiencies by streamlining critical processes like loan origination, contract management, and collections — so you can scale with confidence.

Integrated data and AI-powered credit analysis enable faster credit evaluations, accurate risk scoring, and seamless decision-making across teams.

Designed to meet local compliance, integrate with regional systems, and support financing models specific to Australian lenders—making it ready to implement from day one.

Transcend Finance uses advanced AI capabilities, enhanced by Robotic Process Automation (RPA), to drive smarter operations and better outcomes. Here’s how it directly addresses your operational pain points and drives better outcomes:

AI delivers real-time data analysis for faster, more accurate lending decisions. Reduce risk, improve approval times, and support consistent underwriting.

Streamline document extraction, validation, and compliance checks. Eliminate manual errors and stay audit-ready with AI-powered automation.

Gain deeper, contextual credit risk analysis that enables smarter decision-making, optimizes loan structures, reduces default rates, and accelerates credit evaluations.

Combine AI with Robotic Process Automation to streamline credit tasks like data gathering, stipulation generation, and routing—freeing teams to focus on strategic, value-driven decisions.

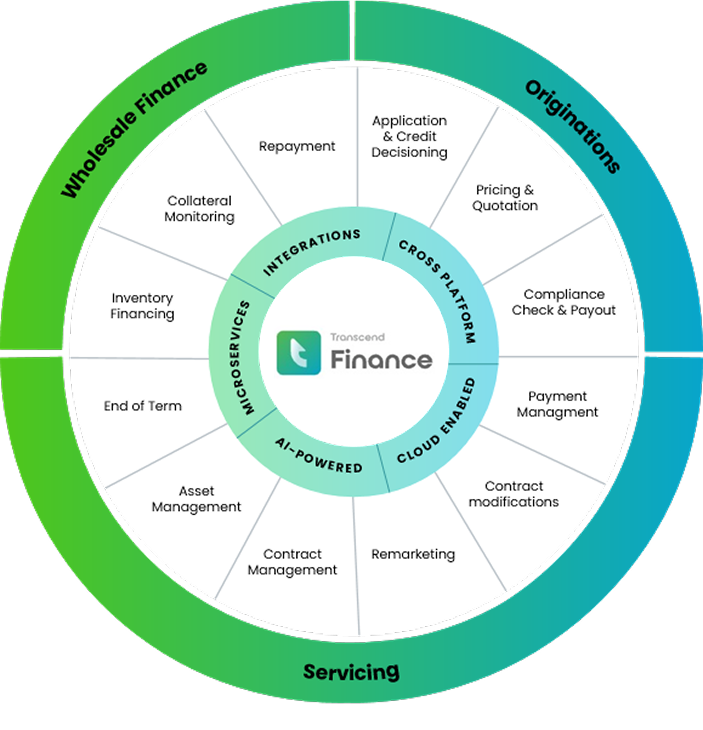

Streamline origination, servicing, and wholesale finance with Transcend Finance — built for auto captives, lenders, and financial institutions.

AI-powered underwriting, instant credit approvals, and digital onboarding to close deals quicker.

Manage contracts, payments, and compliance with real-time transparency and automation.

Flexible inventory financing and real-time to keep your supply chain agile.

Accelerate deal velocity, enhance customer experiences, and streamline operations across retail and wholesale finance.