A Strategic Partner in Wholesale Finance

NETSOL isn’t just a platform provider—we bring deep wholesale finance expertise and serve as an extension of your team, offering responsive, specialised support from people who understand your business.

Transcend helps you move faster, scale smarter, and support your dealers better—with modular tech, AI-powered automation, and real-time account support that fits right into your existing ecosystem.

Transcend Finance brings together OEMs, lenders, dealers, and auditors across the wholesale lifecycle. The platform combines real-time dealer portals, AI-powered workflows, and industry best practices to deliver compliance and efficiency at scale. Dedicated account managers provide support, while mobile apps like mDealer give dealers simple tools for financing, inventory, and payments.

Give dealers a live view of available credit lines, approved inventory, and outstanding balances with mDealer. Enable faster drawdowns, streamline repayments, and improve credit utilisation across the floorplan lifecycle.

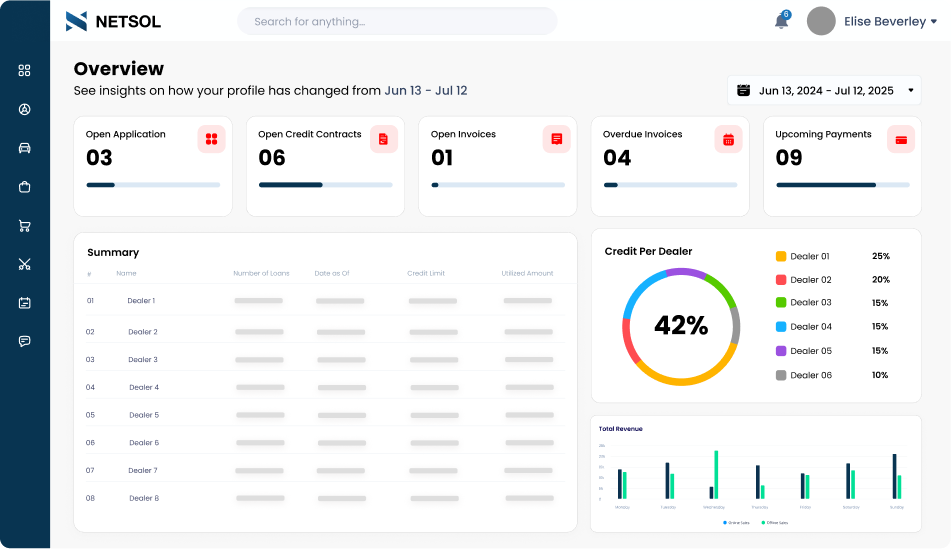

Track dealer performance, credit exposure, funding requests, and compliance status in one unified dashboard. Reduce manual tracking and enhance control across your dealer network.

Digitally reconcile financed inventory using real-time data inputs, including location tracking and floor checks. Identify discrepancies early and reduce risk exposure across financed assets.

Design flexible credit programs per dealer profile with built-in controls for caps, aging, curtailments, and exceptions. Monitor usage and enforce terms without constant manual oversight.

With automated data extraction, enriched credit insights, and real-time anomaly detection, Transcend delivers faster underwriting, greater accuracy, and built-in compliance for smarter lending decisions.

Stay ahead with instant visibility into inventory levels, loan balances, invoices, and credit utilisation—fully integrated with your backend systems.

Easily monitor maturing assets and manage curtailments or term adjustments on demand, reducing risk and improving asset control.

Identify low or excess stock across locations and initiate asset transfers instantly to balance demand—no spreadsheets, no lag.

Customisable dashboards and real-time notifications ensure every stakeholder, from floor staff to regional heads, sees exactly what they need to act fast.

Understand the real operational cost of outdated systems—and how to prioritize automation that delivers ROI.

We’ve officially launched localized versions of our retail platform to support growing demand across key EU markets.

The panel explores AI’s three adoption pillars, why many start with traditional tools, and how AI integration drives measurable business impact.