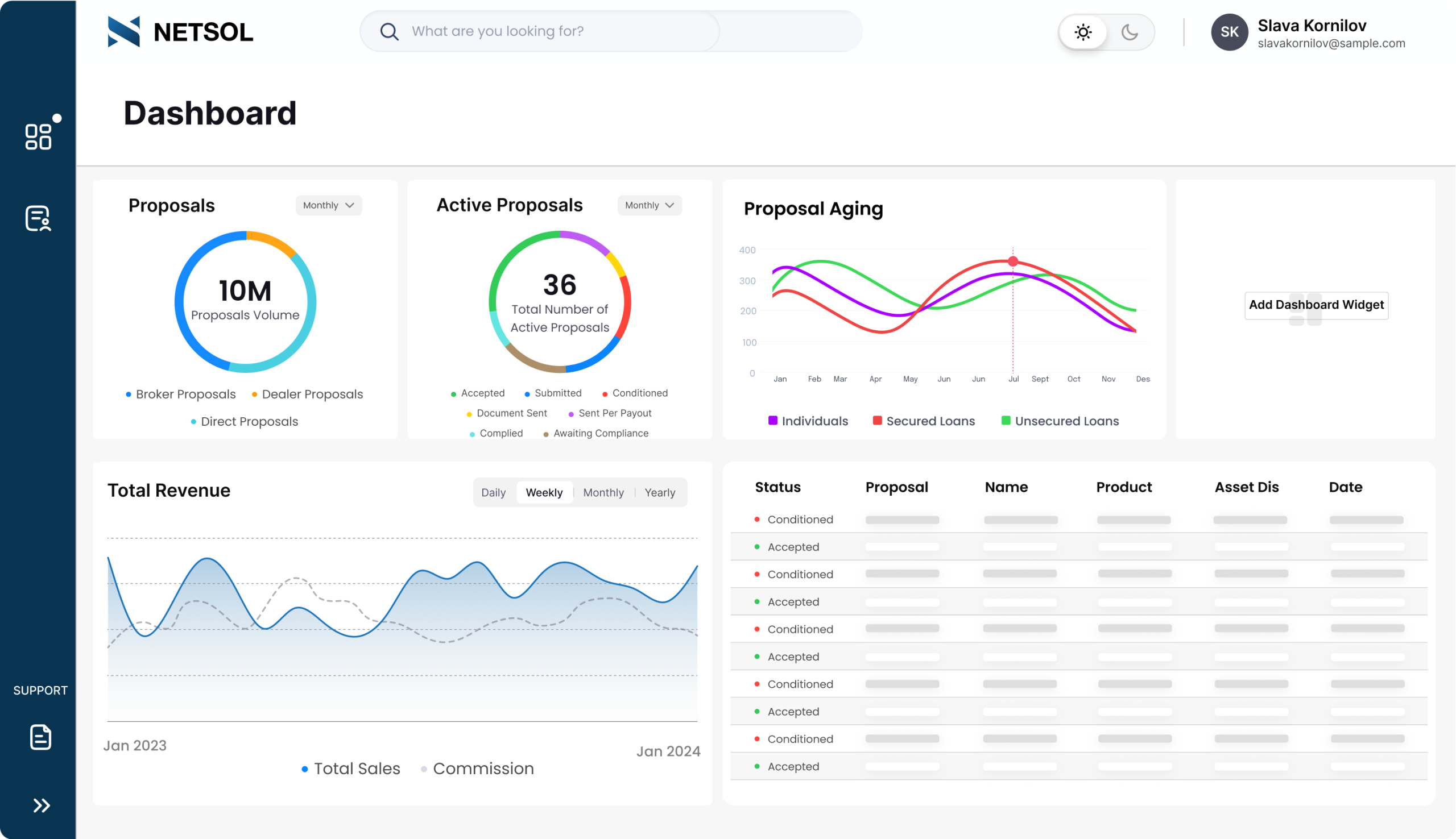

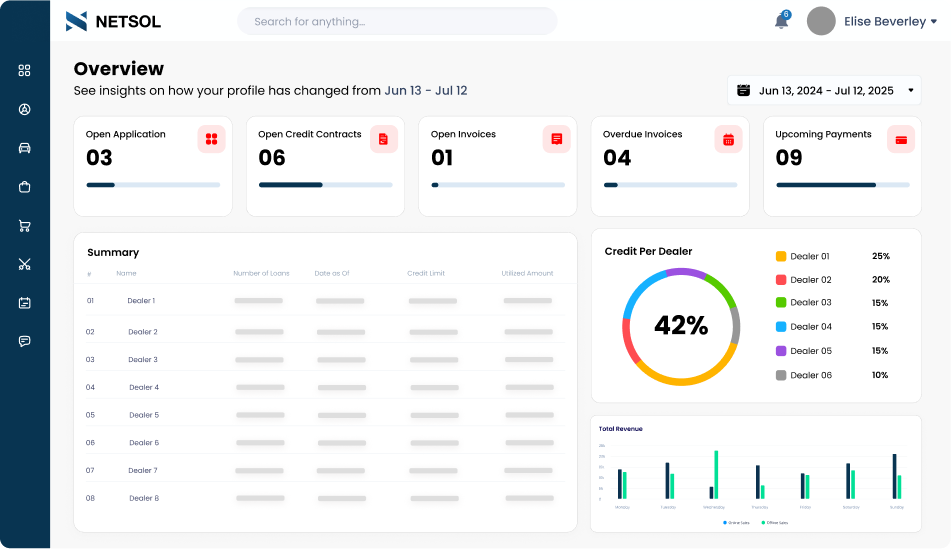

Cloud-Native, Modular, AI-Powered Equipment Finance Platform

Manage captive and independent equipment finance on an API-first architecture built for fast originations, flexible product structures, streamlined servicing, and compliant lifecycle management.